A new EIC study for the first time measured the full scope and economic significance of the $1.6 trillion USD global events industry. Both before and after the COVID-19 pandemic, the ripple effects go well beyond direct event spending.

The Events Industry Council, in partnership with Oxford Economics, for the first time measured the role business events play in vital economic indicators that fall outside the boundaries of direct event spending — from knowledge sharing and innovation to employee engagement. What they found in the new EIC study, the 2023 Global Economic Significance of Business Events, was that the $1.6 trillion USD worth of the global events industry does in fact extend far beyond direct spend on hotels, meeting venues, AV and on-site food and beverage.

Oxford Economics first established the pre-pandemic economic impacts of the global events industry as of 2019. Among the findings were that the pre-COVID industry included 1.6 billion participants across 180 countries, generated direct spend of $1.2 trillion and total business sales of $2.8 trillion (a 9.1% increase over 2017, the prior year reported by the EIC), and provided 27.5 million total jobs. With an average spend per participant of $707, as a whole, the global industry contributed $1.6 trillion to the global GDP.

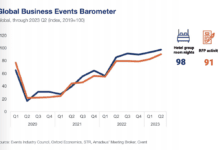

Then along came COVID-19, with in-person event shutdowns that cost the global economy $1.9 trillion from 2020 to 2022. While the industry had begun to recover in 2022, expected spending was still down about 20% over 2019, the study found. Even with an increase of almost 80% in direct spending on business events in 2022 — led by the Middle East, North America, and Central and Eastern Europe — global business activity, while still rebounding, was around 20% lower than in 2019.

“The industry has made significant strides to recover losses,” said Adam Sacks, President of Tourism Economics, an Oxford Economics company. “Two-thirds of global direct business event spending was lost in 2020. The three-year cumulative lost sales total $1.9 trillion USD.” He added, “Now we have the data to show that the business events total GDP impact would rank as 13th largest global economy and recovery is well underway. The economic implications are massive.”

Amy Calvert, Events Industry Council CEO, agreed. “Business events is a $1.6 USD trillion industry, with a GDP larger than many global economies. The economic significance of the global business events industry is immense, and so are its broader impacts,” she said. “Events are a catalyst for meaningful change. Across industry sectors, organizations and individuals all gain in ways that are fundamental to advancement, innovation and adaptation to a changing world. The way we understand, measure and communicate the importance of business events is vital to showcasing its overall value.”

EIC Study: Catalyst Effects

The study also went beyond just measuring the before- and aftereffects of COVID shutdowns, finding that the meeting and events landscape is evolving far beyond its roots in knowledge sharing. In fact, 41% said business events will be increasingly important in building culture and engagement, and 36% believed events will be increasingly used to advance individual employee growth.

As for those wide-reaching ripple effects, which in the report are referred to as “catalytic” effects, a global survey of more than 1,600 meeting professionals, exhibitors and venues in 2022 found that face-to-face meetings and events are crucial to maintaining relationship-building, worker collaboration and business development. Specifically, the findings revealed that:

- Event organizers said relationship management, awareness and new customers are their top indicators for measuring the catalytic impacts of business events.

- While there are many benefits to face-to-face meetings, building relationships through face-to-face interaction was most difficult to replace, said 67%.

- New customer generation also is a key benefit to in-person events, with up to 22% of new customers being acquired through face-to-face interactions.

- The loss of revenues when organizers are unable to host in-person events is significant. Forty-four percent said this was the case, while 65% said that the COVID-19 shutdowns of in-person events let to a significant loss of innovation, including a reduction in research and development prioritization.

- While 48% of those surveyed said they expect the size of meetings and events to decline in the short term, only 10% think this will be a lasting trend.

View the executive summary or purchase the full report on the EIC website.

You May Also Be Interested In…

IRF 2023 Trends Report: Challenges Ahead

2023 Roadmap: Planners Share Their Concerns and Strategies