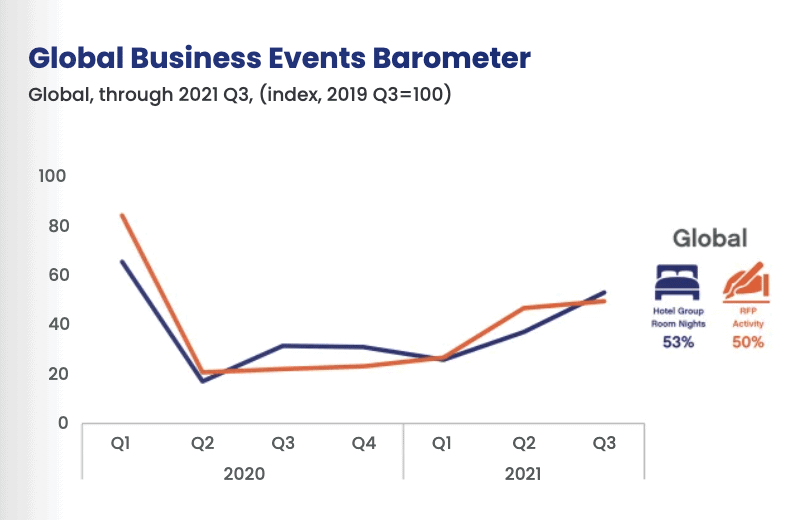

The Global Business Events Barometer just launched by the Events Industry Council found that group business increased significantly in Q3 of 2021, compared to the same time last year. However, the meetings and events industry is still at just about half of what it was before the pandemic.

The Events Industry Council (EIC)’s newly launched Business Events Barometer, which measures changes in the meetings and events market relative to what they were in 2019 before COVID-19 hit, found that both hotel group room nights and requests for proposals (RFPs) were up significantly in Q3 this year over the same period last year, though they still fall short of pre-pandemic levels.

The Global Business Events Barometer, created by Oxford Economics on behalf of the EIC as part of the 2021 EIC Economics Significance Study, found hotel group room nights had increased 124% during Q3 2021. RFPs were up almost 69%. Business travel was also on the rise in Q3, with 57% of companies saying their employees were traveling domestically — more than double the number who said the same a year ago. Approximately 20% also said they were either continuing or restarting travel internationally. While the percentage may seem small, it is triple what it was in Q3 2020.

The Global Business Events Barometer also found that smaller events appear to be recovering more quickly than large and medium events, and events are being booked with shorter lead times.

The upshot of the Global Business Events Barometer’s findings is that the meetings and events industry is back to about half of where it was in 2019, with RFP activity back to 50% of Q3 2019 levels and hotel group room nights at 53% of where they were at this time two years ago.

“The latest data show that business events, which collapsed during the early stages of the pandemic, are substantially resuming,” summed up Adam Sacks, Managing Director, Oxford Economics. “Global activity is still far short of pre-pandemic levels, but this first leg of recovery underscores the importance of business meetings and events to individual and corporate performance.” Hotel group room demand was strongest in the Middle East, Asia Pacific and North America regions. When it comes to RFPs for future events, North America, Latin America, the Caribbean and the Middle East are showing the strongest recovery.

Amy Calvert, EIC’s CEO, added that “It is encouraging to see that the global business events sector is showing continuous signs of growth, with the results indicating a strong demand for the return of face-to-face events, over virtual and hybrid options.”

However, while the industry has made good progress, emerging variants such as omicron, which currently is causing a surge in much of the U.S. and around the world, make COVID a continuing challenge to a full recovery. “We must continue to listen to the facts and scientific data and use this to help us make the necessary decisions and implement the appropriate measures to enable our industry to push forward with its recovery,” said Calvert. “While we focus on building trust and confidence, we have remarkable examples from across the global of business events not only happening safely but offering tremendous value and impact.”

The Global Business Events Barometer was created by Oxford Economics using data provided by Amadeus’ MeetingBroker distribution platform, Cvent, the Global Business Travel Association and STR Global.

The full report is available for download here.

You Might Also Be Interested In

Survey: Omicron’s Effect on Meetings

Omicron Variant Is Already Impacting In-Person Events