Rising costs and stalled budgets are still among the top challenges keeping meeting and event planners up at night, according to a new survey from Global DMC Partners.

Rising costs and stalled budgets are still among the top challenges keeping meeting and event planners up at night, according to a new survey from Global DMC Partners.

Among the top challenges revealed in the Global DMC Partners Q4 2023 Meetings & Events Pulse Survey were trying to find ways to mitigate rising expenses when their budgets have basically stagnated. The survey, conducted in December 2023 through January 2024, collected 246 responses from an evenly split group of corporate/direct planners, agency/third-party planners and others, including freelancers and suppliers.

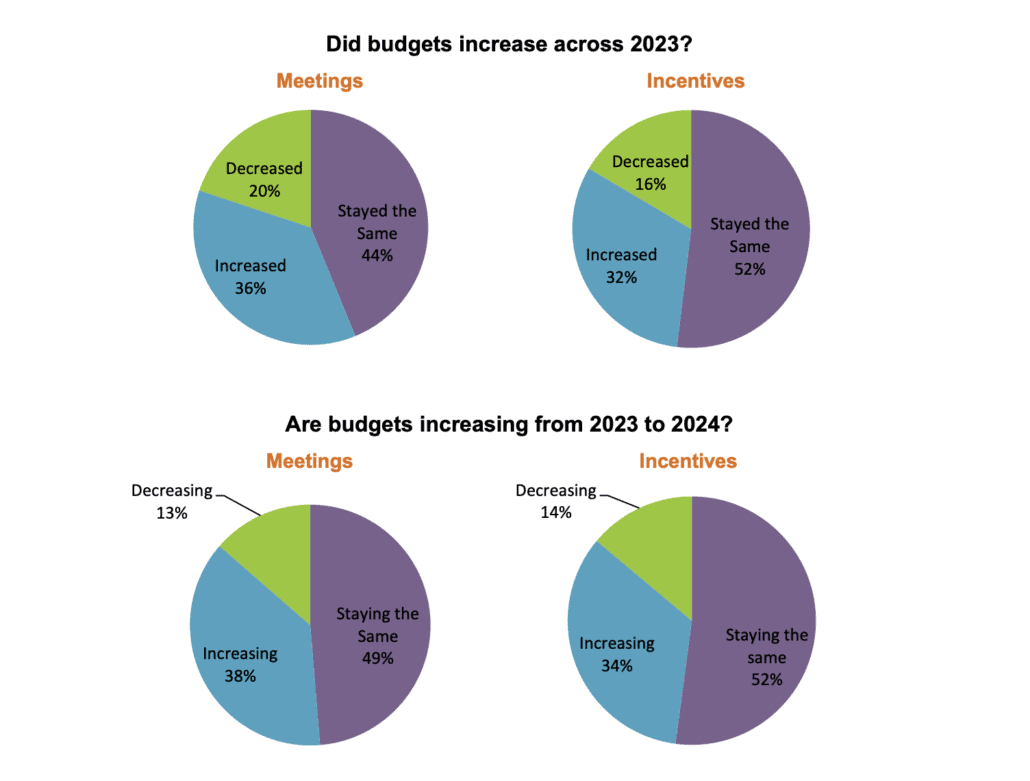

Rising costs continue to plague meeting and event planners, with some reporting that their budgets aren’t keeping up with inflation. In fact, stagnant budgets were identified as one of the top challenges, with 44% of meeting planners and 52% of incentive planners saying their budgets have remained about the same year over year. About half expected to continue to see flat budget growth in 2024, though an optimistic 30% anticipated their budgets would increase this year.

“We are aware that many of our partners are dealing with clients who are facing pressure to maintain budgets despite increasing costs, creating tension between financial constraints and rising expenses,” said Global DMC Partners President and CEO Catherine Chaulet. “We know from the survey that because of this challenge, various strategies are being implemented; for example, over a third of planners frequently opt for different destinations based on price. This will likely remain an ongoing challenge for the foreseeable future, so it’s important we help support the diversification of approaches.”

In fact, destination prices, including food and beverage, accommodation and taxes, were the top-ranked criteria respondents had for selecting or recommending a destination, followed by perceived quality of experience/property and the cost of flights and attendee travel.

In addition to rethinking destination choices based on cost factors, respondents also said they were adjusting their programs or seeking more sponsors to help keep up with ever-spiraling costs in food and beverage, transportation and hotel rates. Some are reducing the duration of their programs to save on costs, while others are rethinking member benefits and taking gifts out of their budget mid-year. Another cost-cutting tactic about a fifth said they were using most of the time or almost always was building in more leisure time, while about 18% said the same for reducing the number of attendees they planned to host. Other options some said they were taking were to reduce the number of events and meetings they planned to hold for the year and combining several smaller meetings into one larger event.

One option that was not a popular choice was to switch an in-person meeting to a virtual event, something well over half said they would never or rarely do. As one respondent said, “I really do not like virtual meetings; they are cold and impersonal. We need to get back to live meetings, for the connection we make with members.” Hybrid events also were cited as being more costly, more complex to set up, and difficult to integrate into in-person events, respondents said.

As one pointed out, “The cost of a hybrid meeting is much higher with the A/V components. In addition, estimating the number of hotel rooms, meals, etc. is difficult to determine if people are offered a virtual option.”

The remaining top 8 of the top 10 challenges were finding availability; timely approval from decision-makers; contract negotiations; responsiveness; service levels/quality; airline travel/schedules; meeting participation/attendance; and vendor relationships.

Read the full survey results here.

You May Also Be Interested In…

Mike Dominguez on 7 Economic Trends in the Year Ahead

Meeting Planner Pain Points: Inflation, Hidden Fees, Service Gaps and More